gotstamps

Well-known member

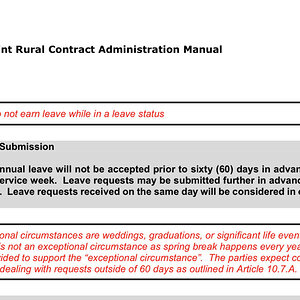

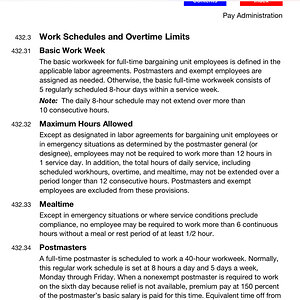

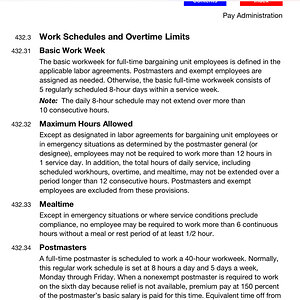

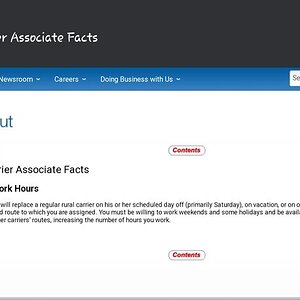

Leave Replacements aren’t allowed per Upper mgmt to work over 12 hours. The F-21 states this also since there is no way to pay OT for the over-12 work portion. Regs are paid OT for the over-12 hours therefore it’s not an issue.The supervisors in our office are also unable to issue daca3. Interestingly the rcas have an 8 day consecutive rule where they're not letting them work more than 8 days in a row and no more than 12/day (a good rule imho)

While regular carriers are working kdays and Sundays sometimes 12+ hours a day.

As to the “8-day” rule, it doesn’t exist except with mgmt. Any sub sitting at home while a Reg works OT, routes are split, OR a sub is borrowed from a different office has a Grievance & would be paid for it. Most subs won’t file as they are happy to have a day off.